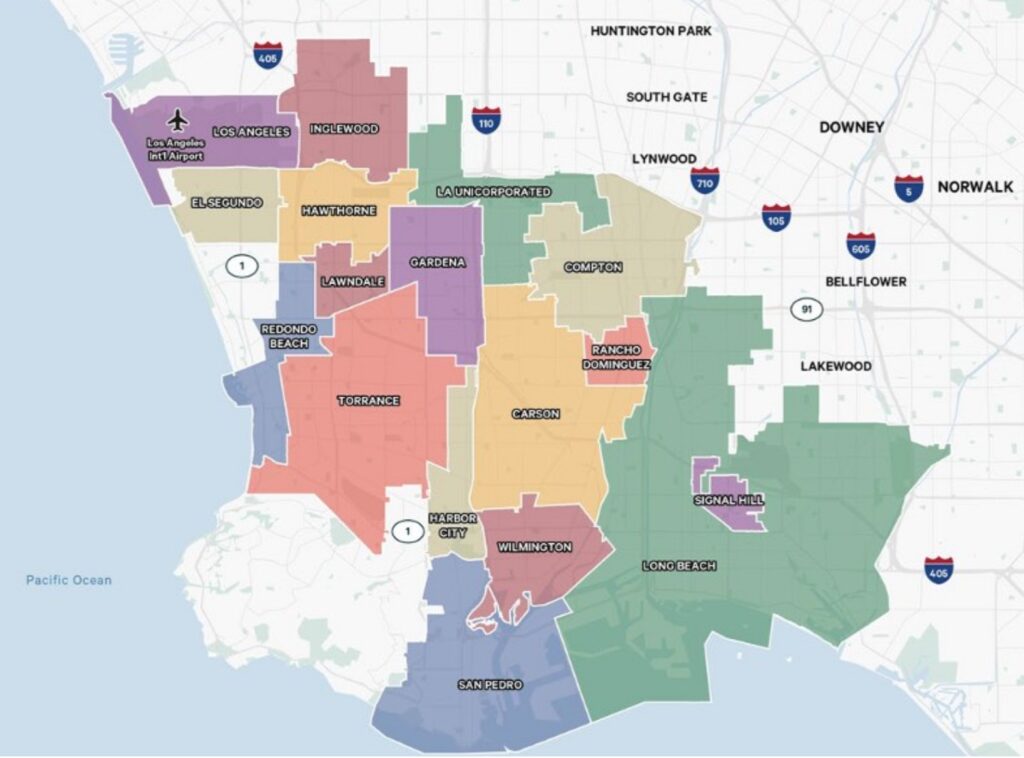

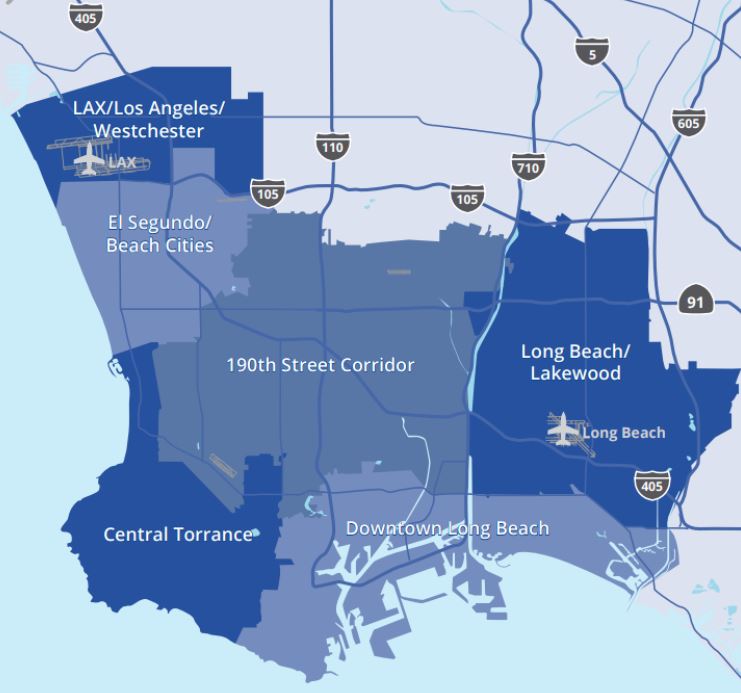

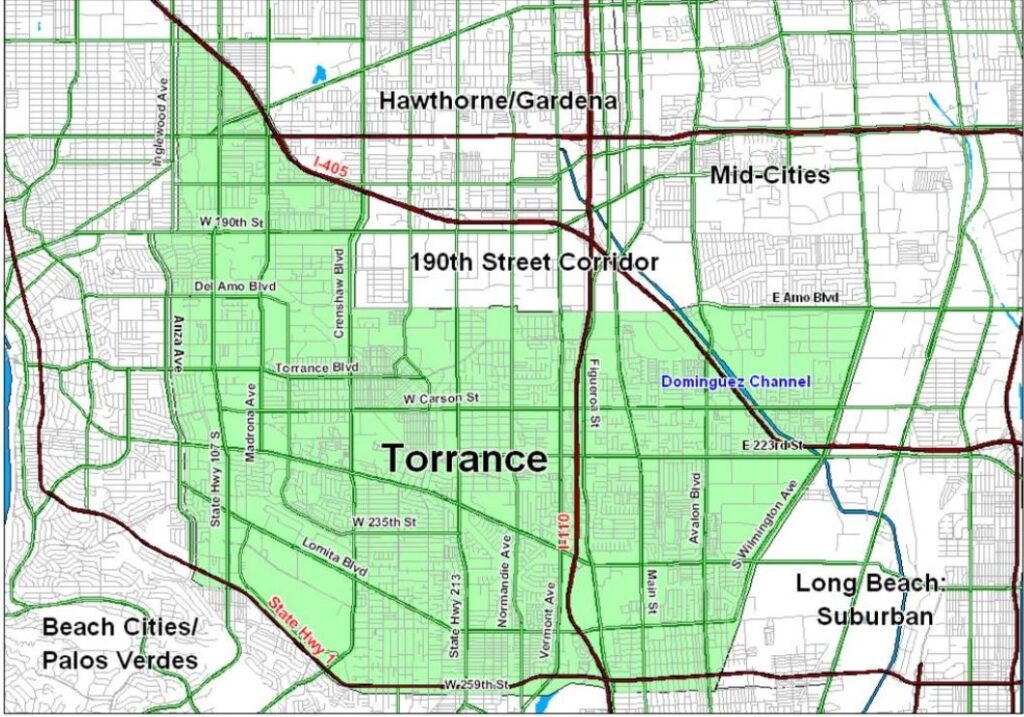

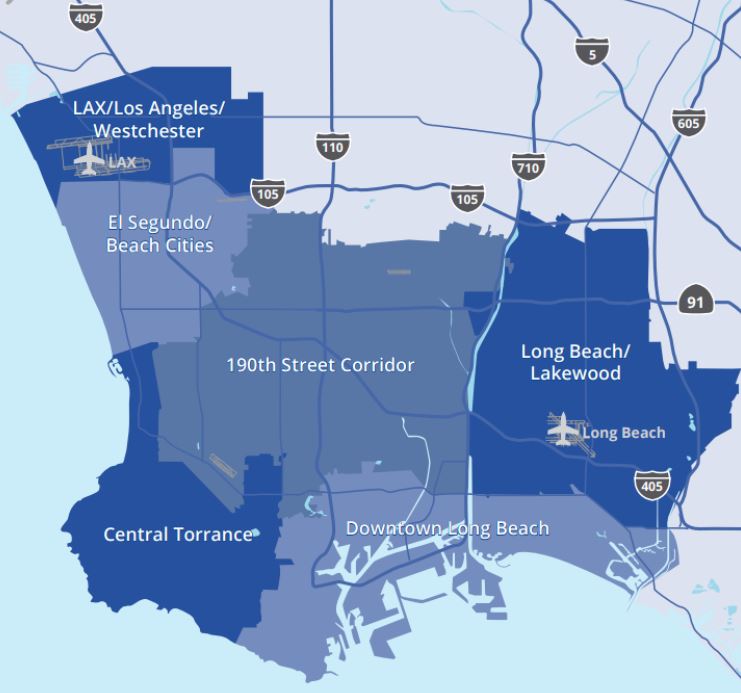

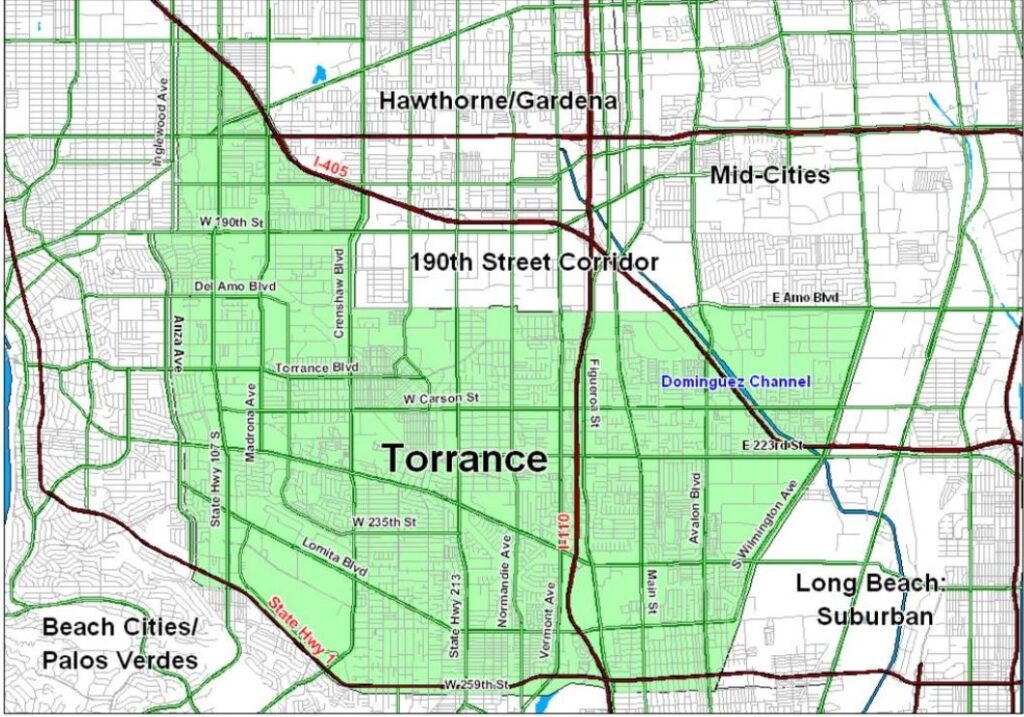

Maps of Torrance and South Bay

South Bay – Southern Section Market Overview

The South Bay office market spans several key cities, with Torrance/Redondo Beach at the southern end and Manhattan Beach/El Segundo (the LAX Area) at the north end. The LAX Area which covers approximately 10 square miles, has seen rapid development and strong leasing demand. This growth is fueled by industries like entertainment, technology, media, software, private equity and financial services.

Torrance and Redondo Beach Office Space

By contrast, Torrance and Redondo Beach offer a less expensive option for renting office space across a 25 square-mile area. Class A office space is limited, but there are a few high-quality buildings in the financial district on Hawthorne Boulevard and also along the 190th Street corridor. These premium offices typically lease for around $3.25 per square foot or more.

Why Torrance Stands Out: Location and Major Employers

Torrance is located about 10 miles south of LAX. It remains a strategic business hub as the southernmost coastal cities of Los Angeles County. Major companies and headquarters include:

Business-Friendly Amenities and New Developments

Torrance is also known for an updated Del Amo Fashion Center, one of the largest malls in the country featuring brands like Tesla, Nordstrom, Coach, Dolce & Gabbana and Tumi.

The Crossing in the financial district and the Enclave on 190th adjacent to the 405 Freeway both attract businesses. These projects, especially Enclave, enhance the appeal of top locations for office space in Torrance.

Torrance Office Market: Stability and Value

Unlike the LAX office market, which has faced challenges from slowdowns in tech, media, and entertainment, Torrance remains steady thanks to its diverse mix of traditional industries. Office rents in Torrance are typically $1.25 or more per square foot lower than similar Class A or B+ properties in the LAX Area, making it a strong value play for tenants.

Browse Torrance Office Space Listings

Explore Torrance Office Space to view high-quality building images, accurate property highlights, and top leasing opportunities in the South Bay market.

Three (3) Helpful Torrance/South Bay Maps

https://torranceofficespace.com/three-good-maps-for-southbay-and-torrance/

#WhyTorrance .gov !